36+ what would i qualify for a mortgage

Get Instantly Matched With Your Ideal Mortgage Lender. Web If your monthly non-housing debts are greater however your total debt payments will exceed 36 of gross income and youll need income to qualify for the mortgage.

How Much House Can You Afford The 28 36 Rule Youtube

Web Lenders consider several factors in determining the amount you qualify for including.

. Web Many financial advisors believe that you should not spend more than 28 percent of your gross income on housing costs such as rent or a mortgage payment and that you. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Web Steps you can take to raise your score include.

Web Getting a mortgage can involve a lot of steps and you wouldnt want to get too far into the process before realizing you wont qualify after all. The prequalification process also is a chance to learn about available. Web To help you choose a mortgage with greater confidence lets examine the six most common types of mortgages.

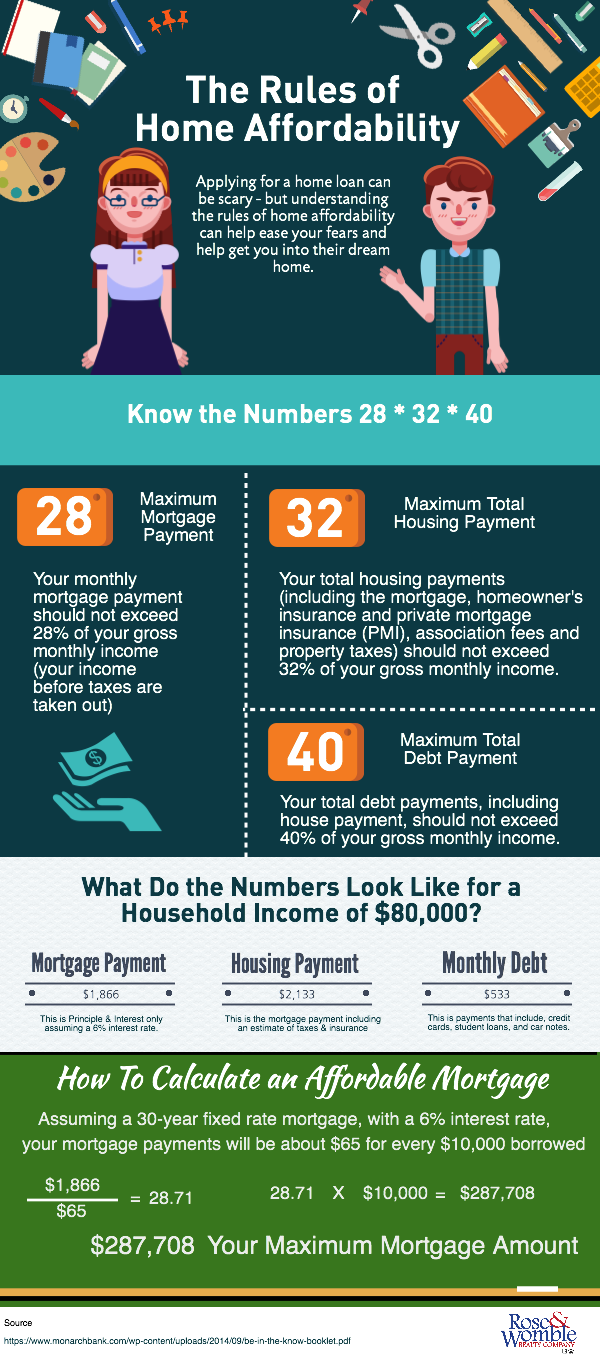

Generally it should be no more than 28 percent of your gross monthly income for the front ratio and 36 percent for the back but the guidelines. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Lock Your Rate Today.

Get Instantly Matched With Your Ideal Mortgage Lender. Lock Your Rate Today. Ad Great Protection and Stackable Discounts.

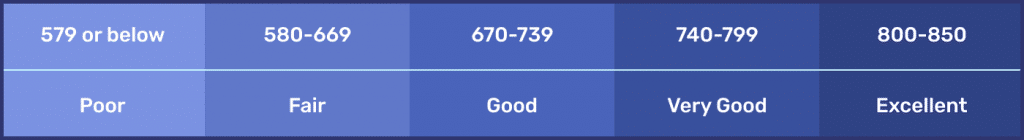

Web Credit score. If your credit score is between 500 and 579 youll need a minimum down payment of 10. For example Fannie Mae requires that a borrowers DTI cant exceed 36 percent of.

Get both from COUNTRY Financial. Pay your bills on time. Take Advantage And Lock In A Great Rate.

Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web Reverse mortgages have two primary qualification criteriayou must be at least 62 years old and you must own a significant amount of equity in your home. Web Mortgage prequalification is a way for prospective homebuyers to discover how much they may be able to borrow for a mortgage.

COUNTRY Consistently Receives High Ratings For Financial Strength And Client Loyalty. Use NerdWallet Reviews To Research Lenders. Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage.

Ad Compare the Best Mortgage Lenders for February 2023. You must have a credit score of at least 500 to qualify for an FHA loan. Talk to your lender if.

Web Now you have your debt ratios. Conventional jumbo FHA USDA VA and 203 k. Your credit score determines the size of the down payment.

Web There are a number of variables that determine what a borrowers DTI should be. Payment history makes up 35 of your credit score. Ad Compare the Best Mortgage Lenders for February 2023.

Compare Now Find The Lowest Rate. Youll need at least a 3 down payment for a conventional loan. Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes.

If your score is 580 or above you only have to put down 35. Debt-to-income ratio DTI The total of your monthly debt payments divided by. Lenders prefer you spend 28 or less of your gross monthly.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Typically lenders will want your total debts to account for no more. Web Credit score and down payment.

Get Instantly Matched With Your Ideal Mortgage Lender. Web Current minimum mortgage requirements for conventional loans Down payment. Web For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000.

The minimum credit score for an FHA mortgage is 500 but if your score is below 580 youll have to make a larger down payment. Get Instantly Matched With Your Ideal Mortgage Lender. Pay down your balances to improve.

Ad Use Our Comparison Site Find Out How to Get Mortgage Pre Qualification In Minutes. Compare Now Find The Lowest Rate.

Glossary Of Mortgage Lending Terminology Rocket Mortgage

How To Get A Mortgage Home Loan Tips

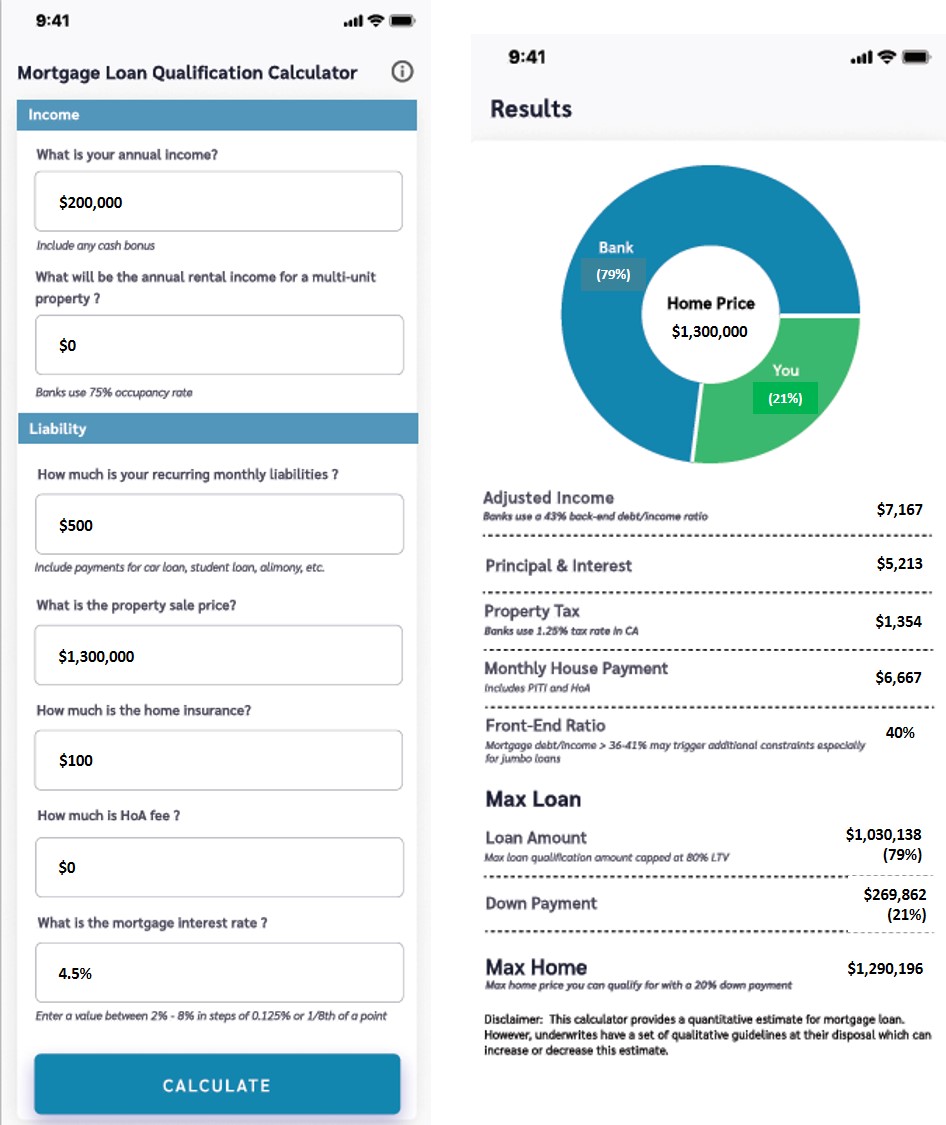

Mortgage Loan Qualification For Different Home Types Fincrafters

Mortgage School The Rules Of Home Affordability Rose Womble Realty Co

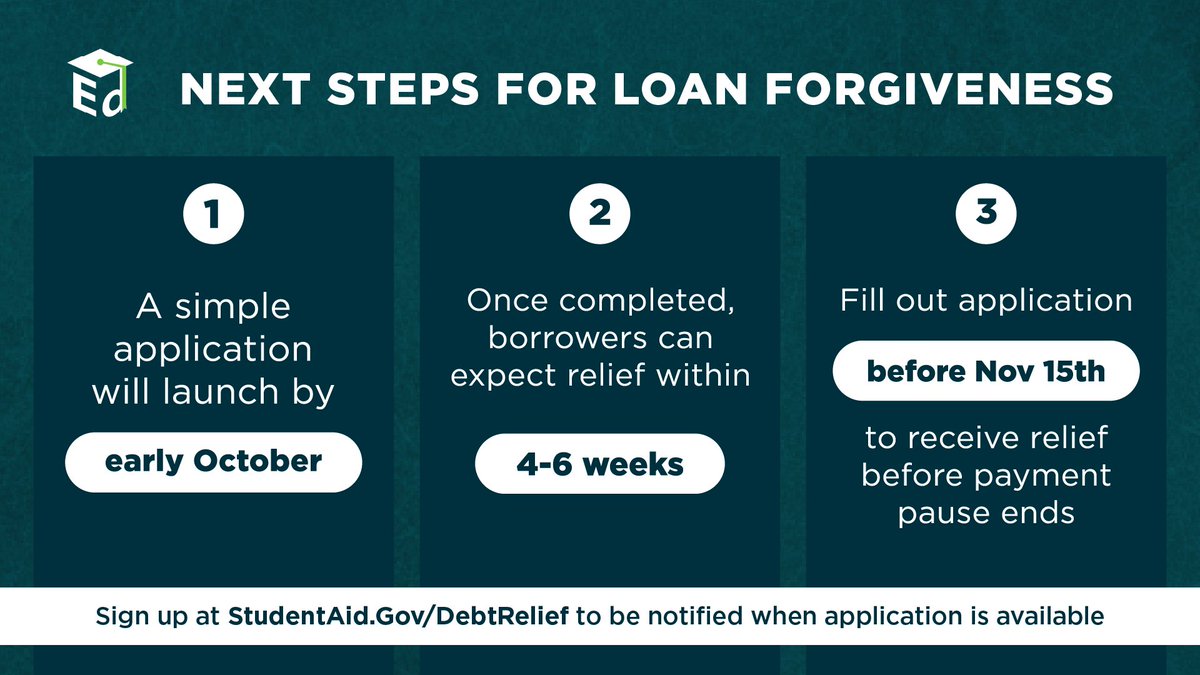

Studentloanadvice Studentloanadv Twitter

Business Succession Planning And Exit Strategies For The Closely Held

Mortgage Minimum Income Requirements Calculator Home Loan Qualification Calculator

Building Greater Strength With Fico Independent Banker

Mortgage Affordability Calculator Estimate Home Loan Affordability Based On Income

How Much A 350 000 Mortgage Will Cost You Credible

How Much House Can I Afford On 36k A Year

How Much House Can I Afford Smartasset

How Much House Can You Afford The 28 36 Rule Will Help You Decide

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

:max_bytes(150000):strip_icc()/getting-your-first-home-insurance-policy-4040509_FINAL-f4d13668216345e6bdc64bbea77b2fa8.png)

What Is The 28 36 Rule Of Thumb For Mortgages

1006 State Highway Zz Niangua Mo 65713 Mls 60231260 Trulia

Is A 35 Year Mortgage Right For You